20162019 ANNUAL MEETING OF STOCKHOLDERS

The 20162019 annual meeting of stockholders is presently scheduled to be held on Tuesday,Wednesday, March 8, 2016.6, 2019. Any proposals of stockholders intended for inclusion in the proxy statement for our 20162019 annual meeting of stockholders must be received by the Secretary of our company at our offices at 870 North Commons Drive, Aurora, Illinois 60504, by Friday, September 25, 2015.21, 2018. If a stockholder of the company intends to present a proposal at the 20162019 annual meeting of stockholders, such stockholder must comply with the advance notice provisions of our bylaws. Those provisions require that such proposal must be received by our Secretary at 870 North Commons Drive, Aurora, Illinois 60504, not earlier than Tuesday, November 10, 20156, 2018 and not later than Thursday, December 10, 2015.6, 2018. Subject to certain exceptions set forth in our bylaws, such proposals must contain specific information concerning the person to be nominated or the matters to be brought before the meeting and concerning the stockholder submitting the proposal.

“HOUSEHOLDING” OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g. brokers) to satisfy the delivery requirements with respect to two or more stockholders sharing the same address by delivering a single Notice of Internet Availability of Proxy Materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means additional convenience for stockholders, cost savings for companies and reduced environmental impact of our proxy materials.Proxy Materials.

A number of brokers with accountholders who are stockholders will be “householding” the Notice of Internet Availability of Proxy Materials. As indicated in the notice previously provided by these brokers to stockholders, a single Notice of Internet Availability of Proxy Materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from an affected stockholder. Once you have received notice from your broker or us that communications to your address will be subject to “householding,” it will continue until you are notified otherwise.

Stockholders who received a householded mailing this year and would like to have additional copies of the Notice of Internet Availability of Proxy Materials mailed to them, or would like to opt out of this practice for future mailings should submit a written request to our transfer agent, Computershare Trust Company, N.A., at P.O. Box 43010, Providence, Rhode Island 02940-3010 Attention: Shareholder Inquiries. We will promptly send additional copies of the Notice of Internet Availability of Proxy Materials upon receipt of such request.

Stockholders who currently receive multiple copies of the Notice of Internet Availability of Proxy Materials at their address and would like to request “householding” of their communications should contact their broker or, if a stockholder is a direct holder of shares of our common stock, they should submit a written request to our transfer agent, Computershare Trust Company, N.A., at P.O. Box 43010, Providence, Rhode Island 02940-3010 Attention: Shareholder Inquiries.

VOTING THROUGH THE INTERNET OR BY TELEPHONE

Our stockholders voting through the internet should understand that there may be costs associated with electronic access, such as usage charges from access providers that must be borne by the stockholder. To vote by telephone if you are a record holder of our common stock, call toll free1-800-690-6903 and follow the instructions provided by the recorded message. To vote by telephone if you are a beneficial owner of our common stock, call the toll free number listed in your Proxy Cardproxy card or follow the instructions provided by your broker. To vote through the internet, go towww.proxyvote.com and follow the steps on the secured website. You also may access the proxyvote website by going to our website,www.cabotcmp.com, selecting “Investor Relations” on our Homepage, and then selecting “Annual Meeting/Proxy” from the dropdown menu.

Appendix A

CABOT MICROELECTRONICS CORPORATION

AUDIT COMMITTEE CHARTER

Purpose

The purpose of the Audit Committee (the “Committee”) of the Board of Directors (the “Board”) of Cabot Microelectronics Corporation (the “Company”) is to oversee the Company’s accounting and financial reporting processes and the audit of its financial statements. The Committee is responsible for overseeing the Company’s accounting and system of internal controls, the quality and integrity of the Company’s financial reports and the independence and performance of the Company’s independent public accountants responsible for the annual audit and quarterly reviews of the Company’s financial statements (“independent auditor”). In so doing, the Committee should endeavor to maintain free and open means of communication between the members of the Committee, other members of the Board, the independent auditor, the senior and financial management of the Company, and with any employees of the Company or other individuals who desire to bring accounting, internal accounting controls, auditing, or other matters to the Committee’s attention.

In the exercise of its oversight responsibilities, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements fairly present the Company’s financial position and results of operation and are in accordance with generally accepted accounting principles. Instead, such duties remain the responsibility of management and the independent auditor. Nothing contained in this charter is intended to alter or impair the operation of the “business judgment rule” as interpreted by the courts under the Delaware General Corporation Law. Further, nothing contained in this charter is intended to alter or impair the right of the members of the Committee under the Delaware General Corporation Law to rely, in discharging their responsibilities, on the records of the Company and on other information presented to the Committee, Board or Company by officers or employees or by outside experts such as the independent auditor.

Membership

The Committee shall consist of at least three members of the Board. The members shall be appointed by action of the Board, upon recommendation of the Nominating and Corporate Governance Committee, and shall serve at the discretion of the Board. Each Committee member shall satisfy the “independence” and other requirements of relevant law, including rules adopted by the Securities and Exchange Commission (“SEC”), and the NASDAQ Stock Market LLC (“NASDAQ”). At least one member of the Committee shall satisfy the “financial expert” requirements of relevant law, including rules adopted by the SEC, and NASDAQ. Each member of the Committee shall be able to read and understand financial statements at the time of his or her appointment.

Committee Organization and Procedures

1. The Chair of the Committee shall be appointed by the Board by majority vote. The Chair (or in his or her absence, a member designated by the Chair) shall preside at all meetings of the Committee.

2. The Committee shall have the authority to establish its own rules and procedures consistent with the bylaws of the Company for notice and conduct of its meetings, should the Committee, in its discretion, deem it desirable to do so. Members of the Committee may participate telephonically in any meeting. A majority of the

members of the Committee shall constitute a quorum for the transaction of business and the action of a majority of the members present at any meeting at which there is a quorum shall be the act of the Committee.

3. The Committee shall meet as frequently as the Committee in its discretion deems desirable.

4. The Committee may, in its discretion, include in its meetings members of the Company’s management, representatives of the independent auditor, outside counsel, the director of internal audit and other personnel employed or retained by the Company, the Board or the Committee. The Committee shall meet periodically and as it deems appropriate with the independent auditor or the director of internal audit, outside counsel or other advisors in separate executive sessions to discuss any matters that the Committee believes should be addressed privately, without management’s presence, and also shall meet periodically and as it deems appropriate in separate executive sessions with the Company’s management.

5. The Committee may, in its discretion, retain and utilize the services of the Company’s regular corporate legal counsel with respect to legal matters or its other advisors with respect to other matters or, at its discretion, retain other legal counsel or other advisors if it determines that such counsel or advice is necessary or appropriate under the circumstances.

6. The Committee shall have its own funding from the Company to pay for the services of the Company’s independent auditors and any legal counsel or other advisors that are retained by the Committee.

7. The Secretary and General Counsel of the Company shall serve as Secretary of the Committee.

Responsibilities

Independent Auditor

8. The Committee has the sole and direct responsibility for selecting, appointing, terminating, compensating and overseeing the Company’s independent auditor, as well as for resolving any disagreements between the independent auditors and management. The Committee shall only retain as independent auditor a firm, including representatives of the firm responsible for the Company’s audit, that meets the requirements of relevant law, the Public Company Accounting Oversight Board (PCAOB), the SEC and NASDAQ. The independent auditor shall be accountable to the Committee for all matters, including the audit of the Company’s annual financial statements and related services. The Committee shall select, appoint and periodically evaluate the performance of the independent auditor and, if necessary, replace the independent auditor. At the discretion of the Committee or to the extent required by relevant law, NASDAQ or the SEC, the Committee shall recommend to the Board the nomination of the independent auditor for stockholder ratification at any meeting of stockholders.

9. The Committee shall pre-approve the fees to be paid to the independent auditor and any other terms of the engagement of the independent auditor for any and all services (whether auditing services, audit-related services, tax services or permitted other (non-audit) services), to be provided by the independent auditor, in advance of such services being provided. The Committee may delegate such pre-approval of services to the Committee Chair, and the Committee Chair shall provide subsequent notification to the Committee of any such pre-approval at the next scheduled meeting of the Committee.

10. The Committee shall receive from the independent auditor and review, at least annually, a written statement delineating all relationships between the independent auditor and the Company, consistent with the PCAOB’s Rule 3526,Communication with Audit Committees Concerning Independence (Rule 3526). The Committee shall actively engage in a dialogue with the independent auditor with respect to any disclosed relationships or services that, in the view of the Committee, may impact the objectivity and independence of the independent auditor. If the Committee determines that further inquiry is advisable, the Committee shall take any appropriate action in response to the independent auditor’s report to satisfy itself of the auditor’s independence.

Annual Audit

11. The Committee shall meet with the independent auditor and management of the Company in connection with each annual audit to discuss the scope of the audit and the procedures to be followed.

12. The Committee shall review and discuss the audited financial statements with the management of the Company.

13. The Committee shall discuss with the independent auditor the matters required to be discussed by PCAOB AU Section 380 Communications with Audit Committees as then in effect including, among others, (i) the methods used to account for any significant unusual transaction reflected in the audited financial statements; (ii) the effect of significant and critical accounting policies in any controversial or emerging areas for which there is a lack of authoritative guidance or a consensus to be followed by the independent auditor; (iii) the process used by management in formulating particularly sensitive accounting estimates and the basis for the independent auditor’s conclusions regarding the reasonableness of those estimates; and (iv) any disagreements with management over the application of accounting principles, the basis for management’s accounting estimates or the disclosures in the financial statements.

14. The Committee shall, based on the review and discussions in paragraphs 11, 12, and 13 above, and based on the disclosures received from the independent auditor regarding its independence and discussions with the independent auditor regarding such independence in paragraph 10 above, recommend to the Board whether the audited financial statements should be included in the Company’s Annual Report on Form 10-K for the fiscal year subject to the audit.

15. The Committee shall review and discuss with management, including the director of internal audit and, at its discretion, any provider of internal audit services, and the independent auditor the Company’s internal controls report and the independent auditor’s attestation of the report prior to the filing of the Company’s Annual Report on Form 10-K for the fiscal year subject to the audit.

Quarterly Review

16. The independent auditor is required to review the interim financial statements to be included in any Quarterly Report on Form 10-Q of the Company using professional standards and procedures for conducting such reviews, as established by generally accepted auditing standards as modified or supplemented by the SEC, prior to the filing of the Form 10-Q. The Committee shall discuss with management and the independent auditor in person, at a meeting, or by conference telephone call, the results of the quarterly review including such matters as significant adjustments, management judgments, accounting estimates, significant new accounting policies and disagreements with management. The Chair may represent the entire Committee for purposes of this discussion.

Internal Controls

17. The Committee shall discuss with the independent auditor and the director of internal audit, as well as management, at least quarterly, the adequacy and effectiveness of the accounting, financial and internal controls of the Company, and consider any recommendations for improvement of such internal control procedures.

18. The Committee shall be provided, and discuss with, the independent auditor and with management any material written communications between the independent auditor and management, including any summary of aggregated deficiencies or management letter provided by the independent auditor (or other auditor) and any other significant matters brought to the attention of the Committee by the independent auditor (or other auditor) as a result of its annual or other audit. The Committee should allow management adequate time to consider any such matters raised by the independent auditor (or other auditor).

19. The Committee shall meet with the Company’s Chief Executive Officer, Chief Financial Officer, and other Company management as appropriate and as required by relevant law, including rules adopted by the SEC, PCAOB, and NASDAQ, on a regular basis to discuss the Company’s internal controls structure and procedures and status, and disclosure controls and procedures and status.

Internal Audit

20. The Committee shall review and preapprove the selection of the Company’s director of internal audit, and any termination of employment of such person. The Committee shall be notified in advance of, and at its discretion review and preapprove, the selection of any third party provider of internal audit services. The Chair may represent the entire Committee for purposes of these matters.

21. The Committee shall discuss at least quarterly with the director of internal audit and, at its discretion other provider(s) of internal audit services (if any), the activities and organizational structure of the Company’s internal audit function and the qualification of the primary personnel performing such function.

22. Management shall furnish to the Chair a copy of each internal audit report, and provide summaries thereof to the Committee, to whom it shall furnish a copy of each internal audit report if so requested by the Committee or any of its members.

23. The Committee shall, at its discretion, meet with the director of internal audit and other provider(s) of internal audit services (if any) to discuss any reports or any other matters brought to the attention of the Committee by the director of internal audit or other provider(s) of internal audit services (if any).

24. The director of internal audit and other provider(s) of internal audit services (if any) shall be granted unfettered access to the Committee.

Other Responsibilities

25. The Committee shall review and reassess the Committee’s charter at least annually and submit any recommended changes to the Board for its consideration.

26. The Committee shall review and assess the Committee’s fulfillment of its responsibilities pursuant to the Committee’s charter at least annually and submit its conclusions in this regard to the Board for its consideration.

27. The Committee shall provide the report for inclusion in the Company’s Annual Proxy Statement required by Item 407 of Regulation S-K of the SEC.

28. The Committee shall establish procedures in compliance with requirements of relevant law, including rules adopted by the SEC, and NASDAQ, for addressing matters and complaints brought to the Committee’s attention by employees of the Company or other individuals regarding accounting, internal accounting controls, auditing, or other matters, and shall ensure that such complaints brought by employees are treated confidentially and anonymously to the extent required by law.

29. The Committee shall be responsible for receiving, dealing with, and responding to legal compliance reports relating to actual or alleged material violations of the securities laws, material breaches of fiduciary duties, or similar material violations.

30. The Committee shall have direct access to the Company’s General Counsel, who serves as the Company’s Chief Compliance Officer, and who has operational responsibility for the Company’s compliance and ethics program, who in turn shall have direct reporting obligations to the Committee for related matters.

31. The Committee shall review and approve any related party transaction in advance of the Company’s entering into any such related party transaction, and shall subsequently inform the Board of any such approval.

The Committee, through its Chair, shall report periodically, as deemed necessary or desirable by the Committee, but at least following its regularly scheduled meetings, to the full Board regarding the Committee’s actions and recommendations, if any.

Appendix B

CABOT MICROELECTRONICS CORPORATION

AUDIT COMMITTEE PRE-APPROVAL POLICY FOR SERVICES TO BE PROVIDED

BY INDEPENDENT AUDITOR

The Audit Committee (the “Committee”) of Cabot Microelectronics Corporation (the “Corporation”) has the sole and direct responsibility for selecting, appointing, terminating, compensating and overseeing the Company’s independent auditor, as well as for resolving any disagreements between the independent auditors and management. Pursuant to the Committee’s Charter, the Committee is required to pre-approve the audit and non-audit services performed by the Corporation’s independent auditor in order to assure that the provision of such services does not impair the auditor’s independence. Each type of service provided by the independent auditor will require specific pre-approval at a particular fee level by the Committee.

The Committee, through the Controller of the Corporation or another designated individual, will maintain a list of the Audit, Audit-related, Tax and All Other services that have been pre-approved by the Committee as of the particular date of the relevant list (the “List”), and will revise the list periodically, based on subsequent determinations of the Committee. The term of any pre-approval is twelve (12) months from the date of pre-approval, unless the Committee specifically provides for a different period.

The Committee has delegated pre-approval authority to the Chairman of the Committee, and may delegate such pre-approval authority to others members of the Committee. The Chairman will report any pre-approval decisions to the Committee no later than at its next scheduled meeting. The Committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management.

The annual Audit services engagement terms and fees will be subject to the specific pre-approval of the Committee. The Committee will approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope or other matters.

In addition to the annual Audit services engagement approved by the Committee, the Committee may grant pre-approval for other Audit services, which are those services that only the independent auditor reasonably can provide and such Audit services will be placed on the List. All other Audit services not on the List must be separately pre-approved by the Committee.

III. | Audit-Related Services |

Audit-related services, including internal control-related services, are assurance and related services that are reasonably related to the performance of the audit or review of the Corporation’s financial statements and that are traditionally performed by the independent auditor. The Committee believes that the provision of Audit-related services does not impair the independence of the auditor. The List will contain the pre-approved Audit-related services. All other Audit-related services not on the List, and all internal control-related services, must be separately pre-approved by the Committee.

The Committee believes that the independent auditor can provide Tax services to the Corporation such as tax compliance, tax planning and tax advice without impairing the auditor’s independence. However, the Committee will not permit the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the tax treatment of which may not be supported in the Internal Revenue Code and related regulations. The List will contain those Tax services that the Committee has pre-approved. All other Tax services not on the List must be separately pre-approved by the Committee.

The Committee may grant pre-approval to those permissible non-audit services classified as All Other services that it believes are routine and recurring services, and would not impair the independence of the auditor. The List will contain All Other services that the Committee has pre-approved. Permissible All Other services not on the List must be separately pre-approved by the Committee.

A list of the Security and Exchange Commission’s (SEC’s) prohibited non-audit services is attached to this policy as Exhibit 1. The SEC’s rules and relevant guidance should be consulted to determine the precise definitions of these services and the applicability of exceptions to certain of the prohibitions.

VI. | Pre-Approval Fee Levels |

At the time of pre-approval of services to be provided by the independent auditor, the Committee will establish an approved fee level for such services. Any increase in the fee level for such services will require additional specific pre-approval by the Committee.

VII. | Supporting Documentation |

With respect to each proposed pre-approved service, the Committee will be provided with detailed back-up documentation, regarding the specific services to be provided.

Requests to provide services will be submitted to the Committee by both the independent auditor and the Corporation’s Chief Financial Officer, Treasurer, Controller, or other designated officer, and each will state whether, in their view, the request is consistent with the SEC’s rules on auditor independence.

EXHIBIT 1

PROHIBITED NON-AUDIT SERVICES

Bookkeeping or other services related to the accounting records or financial statements of the audit client*

Financial information systems design and implementation

Appraisal or valuation services*, fairness opinions or contribution-in-kind reports

Actuarial services*

Internal audit outsourcing services*

Management functions

Human resources

Broker-dealer, investment adviser or investment banking services

Legal services

Expert services unrelated to the audit

(* may be allowed in limited circumstances if reasonable to conclude that the results of these services will not be subject to audit procedures; check relevant SEC rules)

| | | | | | | | | | |

| | | | | | | |

| | |

| | | | | | | | |  |

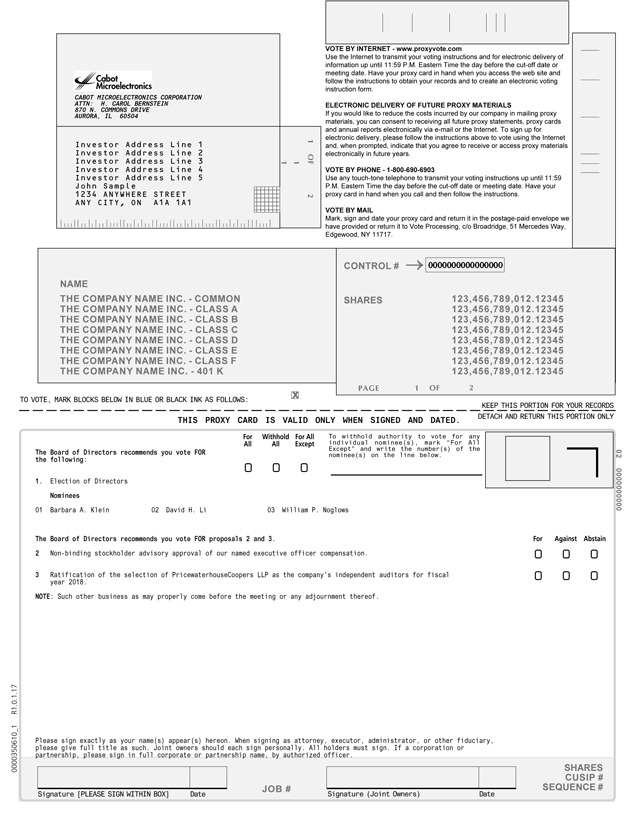

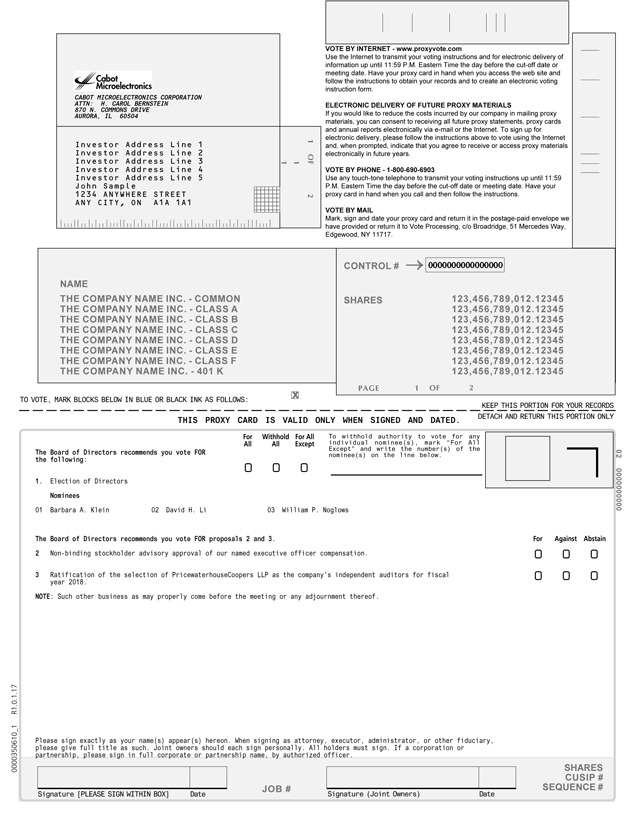

| | | | | | | | VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

| |

| |

CABOT MICROELECTRONICS CORPORATION2018 Proxy Statement

ATTN: H. CAROL BERNSTEIN

870 N. COMMONS DRIVE

AURORA, IL 60504

| | | | ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

| |

| | Investor Address Line 1

Investor Address Line 2

Investor Address Line 3

Investor Address Line 4

Investor Address Line 5

John Sample

1234 ANYWHERE STREET

ANY CITY, ON A1A 1A1

| |

| |  | | VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

| |

| | | | | | | | | | 57 |

| | | | | | | | | | |

| | | | | |

CONTROL #

| | |

| | | | NAME

| | | | | | |

| | | | THE COMPANY NAME INC. - COMMON

THE COMPANY NAME INC. - CLASS A

THE COMPANY NAME INC. - CLASS B

THE COMPANY NAME INC. - CLASS C

THE COMPANY NAME INC. - CLASS D

THE COMPANY NAME INC. - CLASS E

THE COMPANY NAME INC. - CLASS F

THE COMPANY NAME INC. - 401 K

| | SHARES

| | 123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

123,456,789,012.12345

| | |

CABOT MICROELECTRONICS CORPORATION ATTN: H. CAROL BERNSTEIN 870 N. COMMONS DRIVE AURORA, IL 60504 Investor Address Line 1 Investor Address Line 2 Investor Address Line 3 Investor Address Line 4 Investor Address Line 5 John Sample 1234 ANYWHERE STREET ANY CITY, ON A1A 1A1 1 OF 2 1 1 VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. NAME THE COMPANY NAME INC. - COMMON THE COMPANY NAME INC. - CLASS A THE COMPANY NAME INC. - CLASS B THE COMPANY NAME INC. - CLASS C THE COMPANY NAME INC. - CLASS D THE COMPANY NAME INC. - CLASS E THE COMPANY NAME INC. - CLASS F THE COMPANY NAME INC. - 401 K CONTROL # 0000000000000000 SHARES 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 PAGE 1 OF 2 TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: x | | PAGE 1 OF 2

| | |

KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. For All Withhold All For All Except To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below. The Board of Directors recommends you vote FOR the following: 02 0000000000 1. Election of Directors Nominees 01 Barbara A. Klein 02 David H. Li 03 William P. Noglows The Board of Directors recommends you vote FOR proposals 2 and 3. For Against Abstain 2 Non-binding stockholder advisory approval of our named executive officer compensation. 3 Ratification of the selection of PricewaterhouseCoopers LLP as the company’s independent auditors for fiscal year 2018. NOTE: Such other business as may properly come before the meeting or any adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer. 0000350610_1 R1.0.1.17 JOB # SHARES CUSIP # SEQUENCE # Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | For

All | | Withhold

All | | For All

Except | | To withhold authority to vote for any

individual nominee(s), mark “For All

Except” and write the number(s) of the

nominee(s) on the line below. | |  | | |

| | The Board of Directors recommends you vote FOR the following: | | | | | | | | | | | | | | |

| | 1. | | Election of Directors | | | | ¨ | | ¨ | | ¨ | | | | | | |

| | | | Nominees | | | | | | | | | | | | | | | | |

| | 01

| | Barbara A. Klein 02 David H. Li 03 William P. Noglows

| |

| | | | | |

| | The Board of Directors recommends you vote FOR proposals 2 and 3.Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement, Annual Report, Telephone/Internet insert (BR supplied) is/are available at www.proxyvote.com CABOT MICROELECTRONICS CORPORATION ANNUAL MEETING OF STOCKHOLDERS MARCH 6, 2018- 8:00 A.M. Central Standard Time THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS The undersigned stockholder of CABOT MICROELECTRONICS CORPORATION, a Delaware corporation (the “Company”), hereby appoints William P. Noglows and H. Carol Bernstein, and each of them, proxies and attorneys-in-fact of the undersigned, each with full power of substitution, to attend and act for the undersigned at the Annual Meeting of Stockholders to be held on Tuesday, March 6, 2018 at 8:00 a.m., Central Standard Time, at Cabot Microelectronics Corporation, 870 N. Commons Drive, Aurora, IL 60504, and at any adjournments or postponements thereof, and in connection therewith to vote and represent all of the shares of common stock of the Company which the undersigned would be entitled to vote. Each of the above-named proxies at said meeting, either in person or by substitute, shall have and exercise all of the powers said hereunder. In their discretion, each of the above-named proxies is authorized to vote upon such other business incident to the conduct of the Annual Meeting as may properly come before the meeting or any postponements or adjournments thereof. The undersigned hereby revokes all prior proxies given by the undersigned to vote at said meeting. If no instructions are indicated herein, this proxy will be treated as a grant of authority to vote for the proposals and any other matters to be voted upon at the Annual Meeting or at any postponements or adjournments thereof. CONTINUED AND TO BE SIGNED ON THE REVERSE SIDE 0000350610_2 R1.0.1.17

| | | | For | | Against | | Abstain | |

| | 2

| | To approve, by non-binding advisory vote, executive compensation.

| | ¨

| | ¨

| | ¨

| | |

| | 3

| | Ratification of the selection of PricewaterhouseCoopers LLP as the company’s independent auditors for fiscal year 2015.

| | ¨

| | ¨

| | ¨

| | |

| | NOTE:Such other business as may properly come before the meeting or any adjournment thereof.

| | | | | | | | |

| | | | Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer. | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | SHARES

CUSIP #

SEQUENCE #

| | |

| | Signature [PLEASE SIGN WITHIN BOX]

| | Date | | | | JOB #

| | Signature (Joint Owners) | | Date | | | | |

| | |

0000223932_1 R1.0.0.51160 | | 02 0000000000 |

| | | | | | | | | | | | | | | | | | | | | | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:The Notice and Proxy Statement, Annual Report, Telephone/Internet insert (BR supplied) is/are available atwww.proxyvote.com.

|

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | CABOT MICROELECTRONICS CORPORATION

ANNUAL MEETING OF STOCKHOLDERS MARCH 3, 2015- 8:00 A.M.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

| | |

| | | | | | | | | | | | | | | | | | | | | | |

| | The undersigned stockholder of CABOT MICROELECTRONICS CORPORATION, a Delaware corporation (the “Company”), hereby appoints William P. Noglows and H. Carol Bernstein, and each of them, proxies and attorneys-in-fact of the undersigned, each with full power of substitution, to attend and act for the undersigned at the Annual Meeting of Stockholders to be held on Tuesday, March 3, 2015 at 8:00 a.m., local time at Cabot Microelectronics Corporation, 870 North Commons Drive, Aurora, Illinois 60504, and at any adjournments or postponements thereof, and in connection therewith to vote and represent all of the shares of common stock of the Company which the undersigned would be entitled to vote.

Each of the above-named proxies at said meeting, either in person or by substitute, shall have and exercise all of the powers said hereunder. In their discretion, each of the above-named proxies is authorized to vote upon such other business incident to the conduct of the Annual Meeting as may properly come before the meeting or any postponements or adjournments thereof. The undersigned hereby revokes all prior proxies given by the undersigned to vote at said meeting.

If no instructions are indicated herein, this proxy will be treated as a grant of authority to vote for the proposals and any other matters to be voted upon at the Annual Meeting or at any postponements or adjournments thereof.

CONTINUED AND TO BE SIGNED ON THE REVERSE SIDE

| | |

0000223932_2 R1.0.0.51160